Agent-based modeling of the decentralized Liquifi protocol

May 25, 2021

This research study was conducted prior to the implementation of the Liquifi project, to validate the hypothesis of a fairer redistribution of income among market agents compared to competitors.

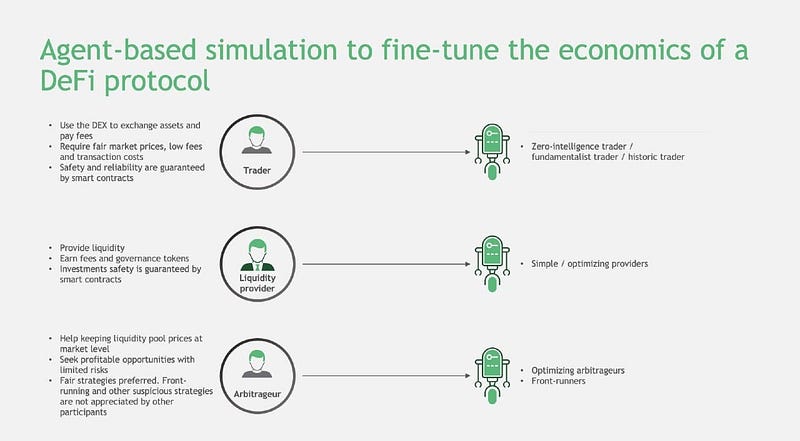

To implement the agent modeling approach, the research team identified 4 market agents of the decentralized exchange :

-Traders

-Arbitrageurs

-Front runners

-Liquidity providers

Each agent of the market is assigned its actions.

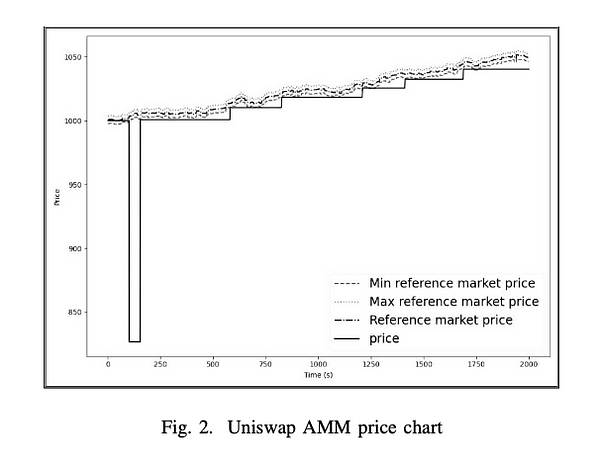

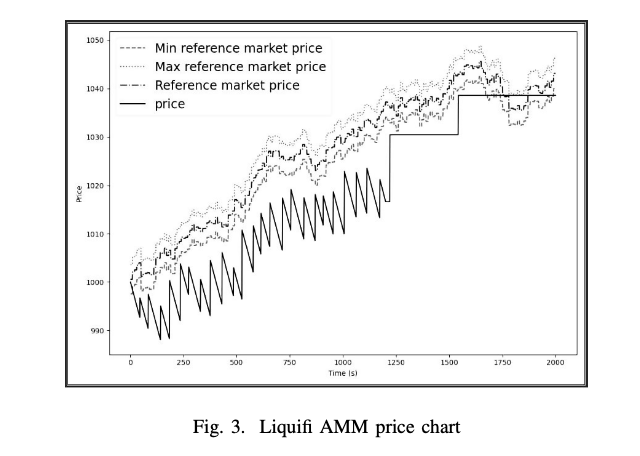

Although both exchanges use the constant product market maker AMM, Liquifi introduces a special type of long time-locked operations that are supposed to be a cure to the price slippage and insertion front running problems. Using the simulation, we can confirm our hypotheses about the different distribution of revenues at each exchange due to their peculiarities. In Figures 2 and 3 we can observe the key difference between the selected AMMs. Specifically, the ETH/USDT token pair price change in the Liquifi model is a sloping line with corrections done by market agents, this is a result of the time-locked operations described in details in the Liquifi whitepaper. In the Uniswap model, the price changes stepwise as a result of swap operations by market agents. We can see that a large exchange operation that occurred at time 100 on the Uniswap market (fig. 2) caused a significant price leap below 850, while on the Liquifi market the operation of the same volume, but stretched in time, did not cause the price to go lower than 990 (fig. 3). This confirms that the time-locked operations effectively reduce the price slippage.

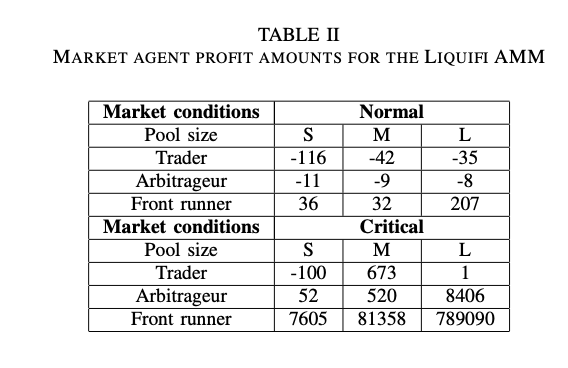

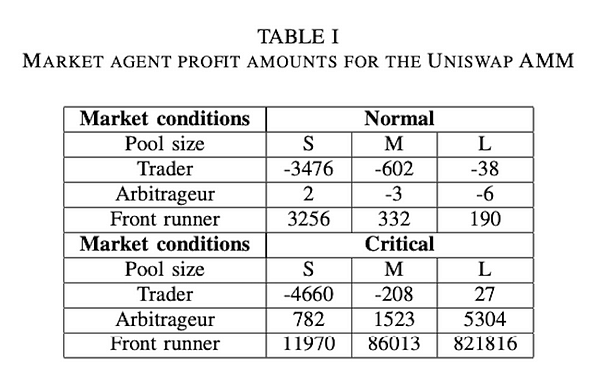

As a result, we created an agent model of Liquifi and Uniswap and then compared the profits of the market agents. The table below shows the average results from 100 simulations for each model configuration.

In order to make the simulation as close to life as possible we added to the model different external market conditions, as well as an experiment with three different pools volumes: S, M, L

When comparing the results of AMM simulations, we were able to find interesting trends depending on the size of liquidity pools. Liquifi shows a significant advantage in activity returns for the trader and the arbitrageur at the size of the liquidity pools M and S, the corresponding charts. When the size of the liquidity pool is large enough (L), the difference from Uniswap is reduced to zero. As a result of the simulation, we confirmed the hypothesis of increasing arbitrage and front running profits in critical market conditions. The results also show that the insertion front running technique cannot be applied to the Liquifi AMM because of the special time-locked operations. The Liquifi whitepaper describes the time-locked operation as a special mechanism that allows a user to split a large volume swap and execute it in parts over time. The time-locked operation should make the swap more profitable for the trader, and counteract the actions of the insertion front runner. At the same time, the Uniswap market is vulnerable to the insertion front running attacks, the simulated insertion front runner profits depending on the pool size.