Impermanent Loss

Apr 1, 2022

Impermanent loss (IL) is the bane of liquidity providers. Even though liquidity provision provides great rewards in terms of tokens, impermanent loss commonly slashes these rewards — significantly.

Since liquidity providers are the backbone of the new decentralized finance system, it would have significant benefits to the ecosystem, and its stability, to improve the position of liquidity providers.

One such approach of improving the position of liquidity miners would be to somehow reduce impermanent loss and hence — increase rewards that are provided for liquidity provision. Blueshift innovated and managed to realize such an approach by reinventing the AMM algorithm.

Before we dive deep into Blueshift’s solution to this matter, let’s first take a closer look at what Impermanent loss is and how it functions.

Impermanent loss root cause and functionality

Impermanent loss is a term that signifies Liquidity providers’ losses due to a price change of an asset.

This phenomenon is a consequence of how the Automated Market Makers(AMM) function.

When a Liquidity Provider provides Liquidity, he or she is entitled to a quantity of provided cryptocurrencies, in a specific ratio. This ratio changes as the value of cryptocurrencies in the Liquidity pool change.

Hence, due to the ratio change, when a Liquidity Provider(LP) is withdrawing their provided liquidity, they might get less value — in received tokens, than the value of tokens that were originally provided by the LP. If this happens, the incurred loss is called Impermanent Loss.

In very simple terms, due to a ratio change of reserves in a liquidity pool — which are used to facilitate trading, the Liquidity Provider receives more tokens that are worth less, and fewer tokens that are worth more.

Usually, this is often offset by trading fees that the LP is entitled to — due to Liquidity Provision. The trading fees do not always offset the Impermanent losses which means all crypto users should perform an in-depth research, before providing Liquidity via AMM protocols.

If the ratio remains unchanged with respect to the moment liquidity was provided, or returns to its initial state that was present at the moment of liquidity provision — the impermanent loss is 0.

This is why Impermanent loss is called ‘Impermanent’ — because there is a possibility the loss will not manifest, as long as Liquidity is not withdrawn before the ratio returns to the factor that was present at the very beginning of Liquidity Provision by an LP.

However, it is common for the ratio to not return to the state which was present during the Liquidity provision.

Impermanent loss has two main drivers: the ratio of tokens in the pool and the number of token types in the pool.

The ratio of tokens in the pool

The more uneven the pool, or in other words — the ratio between assets in a liquidity pool, the less impermanent loss is incurred to liquidity providers.

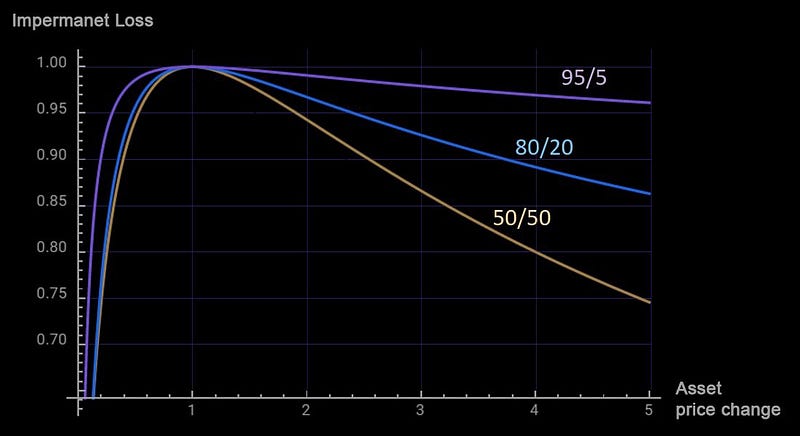

This simple mathematical truth is visualized by plotting out the AMM formula on an XY graph, wherein on the X-axis we have the asset price change, and on the Y-axis we have Impermanent loss.

By using the AMM formula and plotting the impermanent loss parameter, which is individual for almost every AMM protocol — we get the Impermanent Loss curve.

Using this curve, liquidity providers can have a visualization of the IL as well as a look-up tool, as for every price range there is a corresponding IL number on the chart.

As it is evident from the image below, Impermanent Loss is not linear relative to token price change — which means a two-fold increase in the value of a token, relative to another token — does not equal to 50 % decrease in value of the liquidity provided.

From this graph, we can read out that a very uneven pool of a 95/5 ratio will create an impermanent loss of 5 % as a result of a five times increase in the value of the an asset. On the other hand, a pool with a 50/50 ratio will incur approximately 25 % Impermanent loss to a liquidity provider.

Number of token types in the pool

Analogous to the case in which taking more opportunities or simply taking more measurements — statistically results in a more ‘evened out’ scenario(Gaussian distribution), in that same way, more token types in a liquidity pool even out the Impermanent loss across all token types.

In the next article, we will take a closer look into the Blueshift mechanisms that manifest significantly smaller impermanent losses to liquidity providers.

Follow our Medium and social media channels to make sure you don’t miss it!

For clarity, liquidity portfolios in this article were mostly referred to as ‘liquidity pools’. Liquidity portfolios are in essence — liquidity pools that contain more than just 2 types of cryptocurrencies.