Finalising the Cardano Native Token Portfolio Campaign on Blueshift

Aug 19, 2022

It has been an exciting journey for the Blueshift team as we researched and evaluated Cardano projects to list in our first Cardano Native Token Portfolio. We aimed to find the best projects that would offer long-term value for our users and contribute to the growth of the Cardano ecosystem and Blueshift decentralized exchange. Finally, after months of exhaustive research, we have the final short-listed projects from the community engagement. As a result, we confidently know the community’s favourite projects.

In this blog post, we will introduce these projects and tokens and explain the process of being listed.

Community Engagement Phase

We initially started with a broad list of Cardano Native Tokens that were circulating and had good feedback and communities around them. From here, we started a community engagement campaign to measure the level of interest for each community for inclusion in the portfolio.

The Outcome of the Social Engagement Campaign

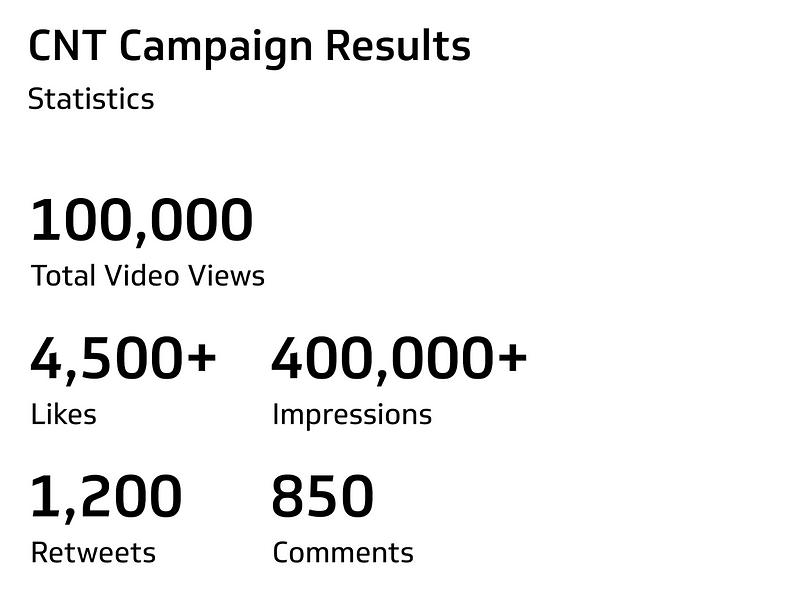

The engagement from each of the project’s communities showed how excited and passionate they were about their projects. Overall the campaign was highly successful.

Based on the level of engagement, it has validated the need for the Cardano community to have its own Cardano Native Token portfolio. There is no better place for this than Blueshift, as it is the perfect place to create these innovative portfolios.

The Cardano Native Token portfolio will be a collection of tokens native to the Cardano blockchain.

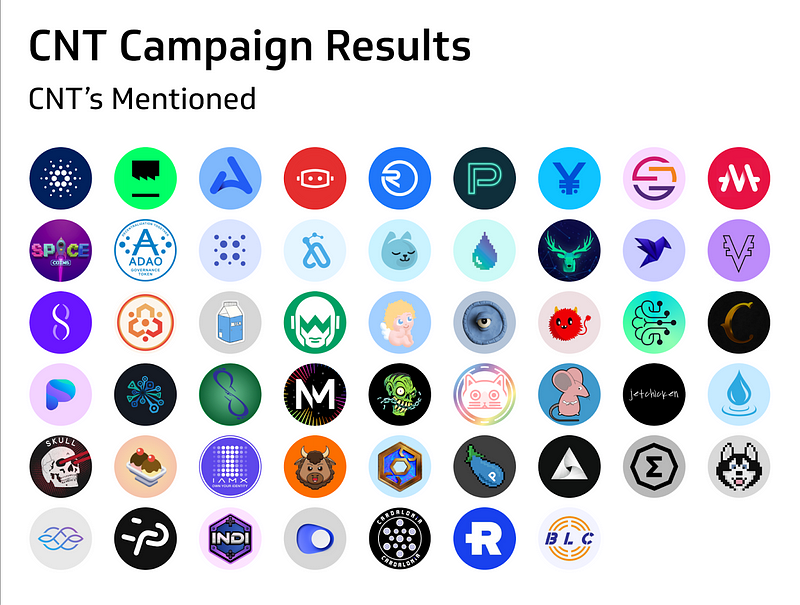

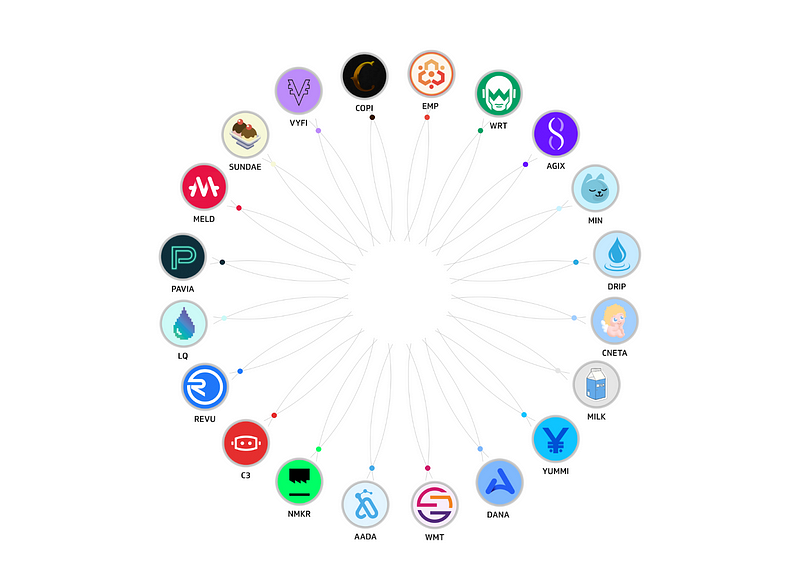

We have concluded the engagement campaign and are happy to present the community’s favourite projects.

The projects illustrated are the short-listed projects which may be added to the CNT portfolio. These are the projects where the community has engaged with our campaign the most.

We have limited space in the portfolio, as we can’t simply include all the tokens in the Cardano ecosystem in a portfolio, and we must finalize the list as soon as possible.

Why Get Listed?

There are many benefits to getting listed on the DEX, and these include:

- Increase trading volume and APR from trading fees

- Low slippage rates with our portfolios and virtual pairs

- Additional financial rewards for staking for those that provide liquidity

As Blueshift continues its expansion to other blockchains, tokens in our portfolios will gain that additional exposure to the new chains. The Blueshift team is actively working on this expansion and will have cross-chain exposure by the end of 2022.

Depending on the level of interest, it may lead to the set-up of other portfolios such as a RealFi portfolio or even a specific Cardano meme coin portfolio (just kidding).

Some projects have reached out early and onboarded, while others are currently in the process. If you haven’t yet reached out, please contact us at pete@blueshift.fi to start the process.

Where to From Here?

Now that we have the short-list, the team must finalise our due diligence process. We’re now entering into negotiations with these projects to all get listed with some projects ready to go!

Our Due Diligence Process

As a part of our research and due diligence process, we will look at qualitative, quantitative & community engagement for each project.

For the qualitative research, we will look at various statistics for each project, such as roadmap, team, user cases and tokenomics, the market capitalisation of the circulating supply and social media engagement from a quantitative perspective.

Finally, we will examine Cardano influencers and thought leaders in the industry to see their thoughts on the various projects.

We are finalizing this process as we engage with various projects to potentially onboard them into the CNT portfolio.

Thank you to the Cardano community, and congratulations to all the projects that made it to the short list of the portfolio. We’d like to thank all our partners and those who have supported the campaign, including Occam, Milkomeda C1, and the Cardano community.

If you haven’t yet checked out our unique portfolio pools, please check out this article about how Blueshift’s portfolio pools differ from traditional decentralized exchange trading pairs. Also, check out our current rewards for providing liquidity on the exchange currently still favourable for liquidity providers.